Life Insurance in and around Boise

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Boise

- Meridian

- Kuna

- Nampa

- Caldwell

- Mountain Home

- Idaho Falls

- Utah

- Oregon

- Idaho City

- Garden City

- Twin Falls

- Melba

- Marsing

- Horseshoe Bend

- Southeast Boise

- Cache Valley

- Salt Lake City

- Pocatello

- Provo

- McCall

- Ontario

- Brigham City

- Rexburg

State Farm Offers Life Insurance Options, Too

State Farm understands your desire to help provide for the people you're closest to after you pass away. That's why we offer great Life insurance coverage options and reliable compassionate service to help you pick a policy that fits your needs.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Why Boise Chooses State Farm

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Brayden Nielson is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

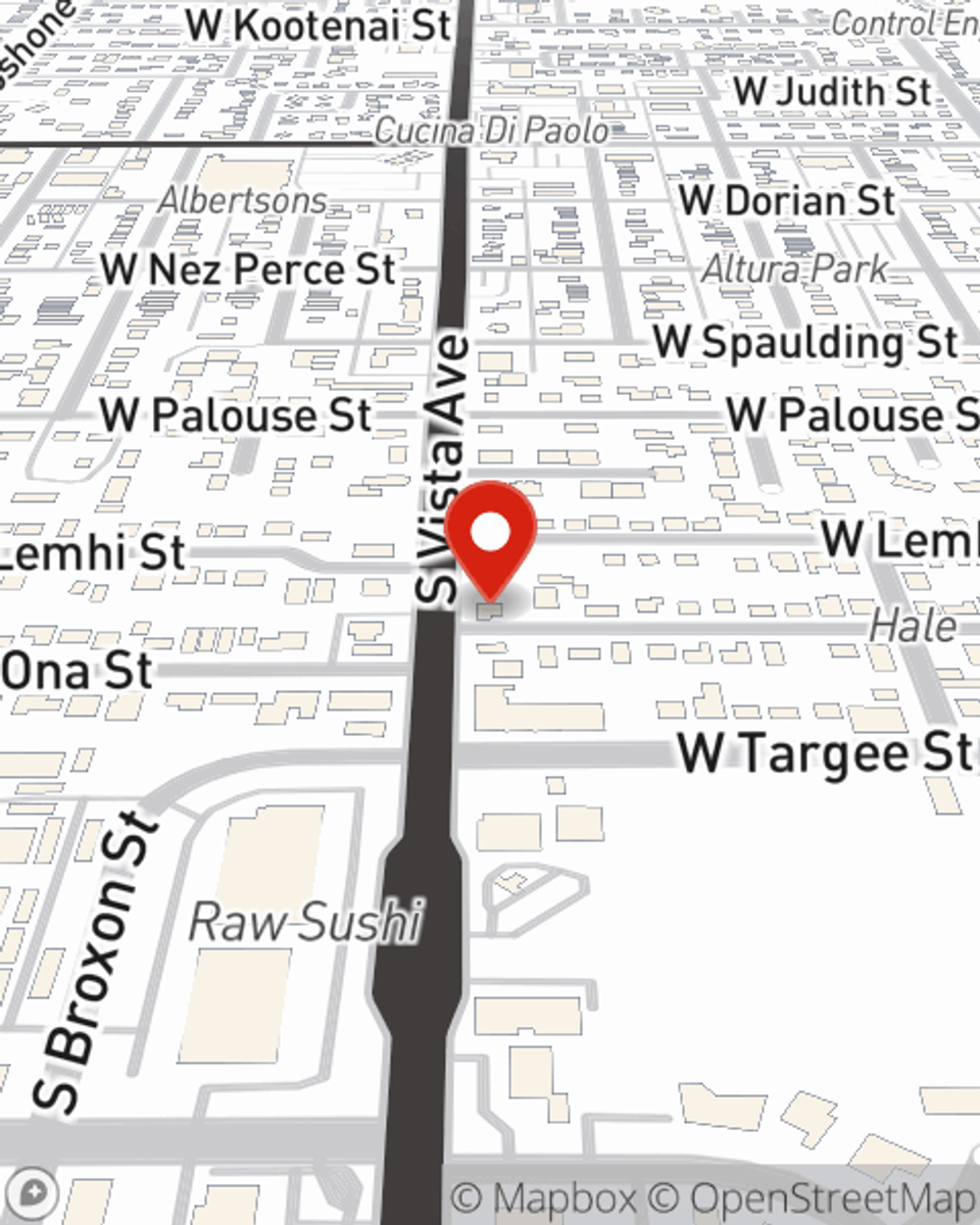

To find out how State Farm can help cover your loved ones, visit Brayden Nielson's office today!

Have More Questions About Life Insurance?

Call Brayden at (208) 367-0367 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Brayden Nielson

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.